Schedule D 28 Rate Gain Worksheet

Schedule D - Viewing Tax Worksheet. To figure your tax on collectibles gain you have to use the worksheet on page 8 of Form 1040 Schedule D instructions.

28 Rate Gain Worksheet Fill Online Printable Fillable Blank Pdffiller

Are looking for information for the current tax year go to the Tax Prep Help Area.

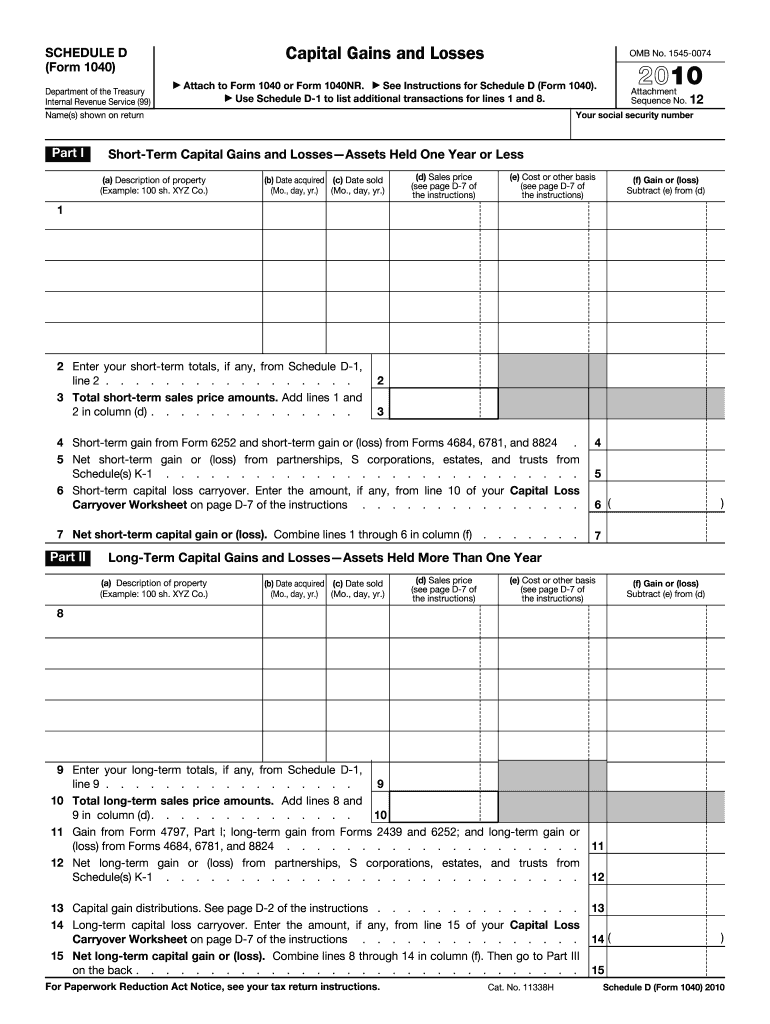

Schedule d 28 rate gain worksheet. Long Term Like-Kind Exchange 28 Rate Amount - The amount entered here goes to the 28 Rate Gain Worksheet Line 3. Long Term Like-Kind Exchange 28 Rate Amount The amount entered here goes to the 28 Rate Gain Worksheet Line 3. 1099-DIV with an amount in Box 2b Collectibles 28.

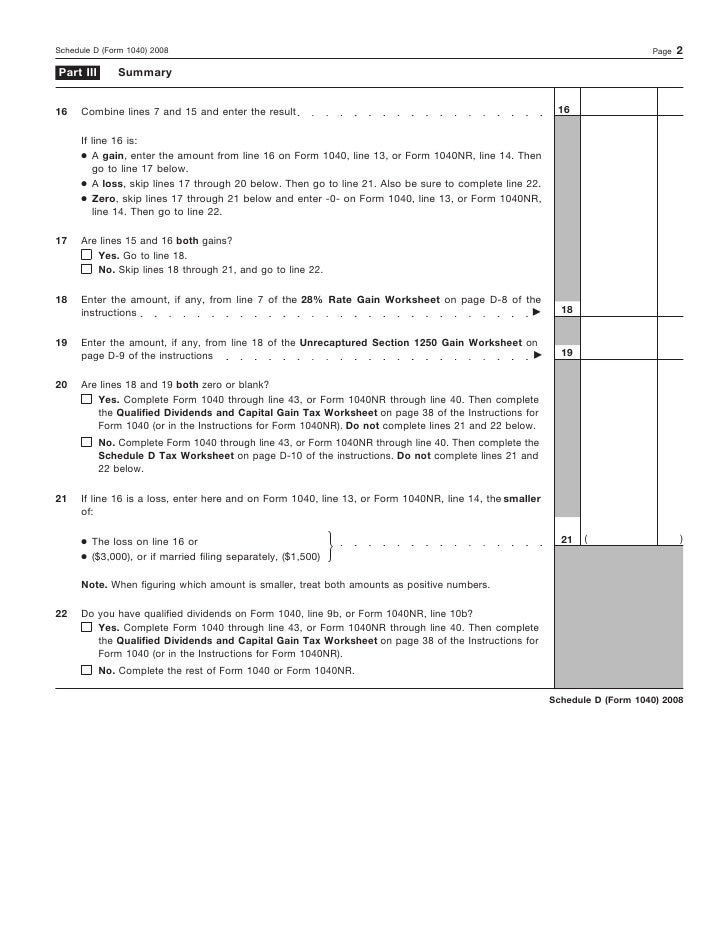

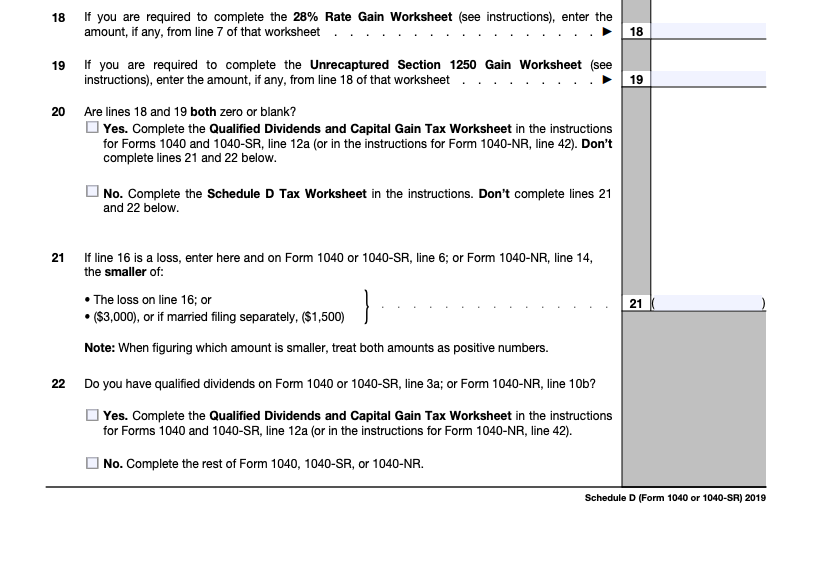

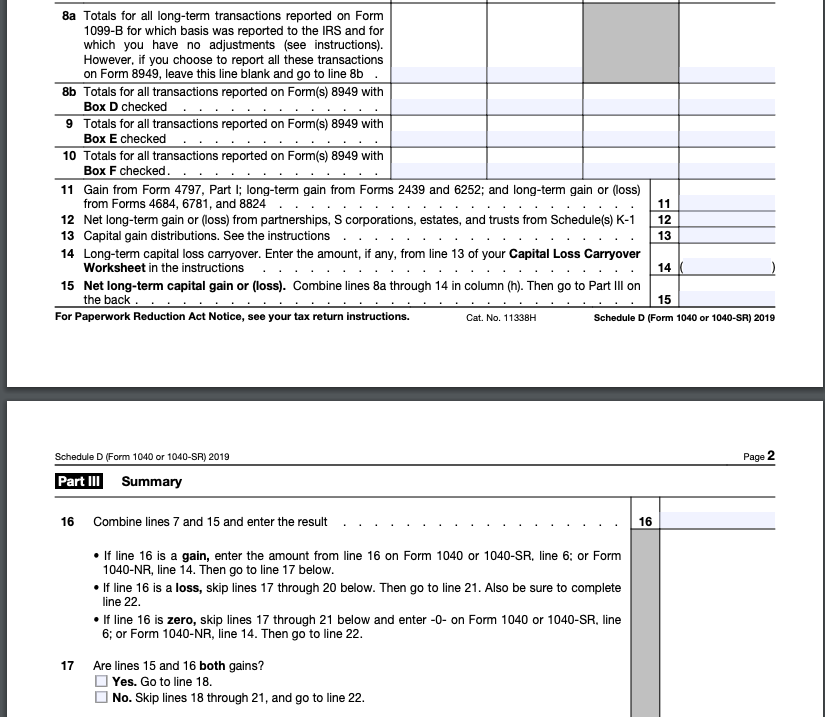

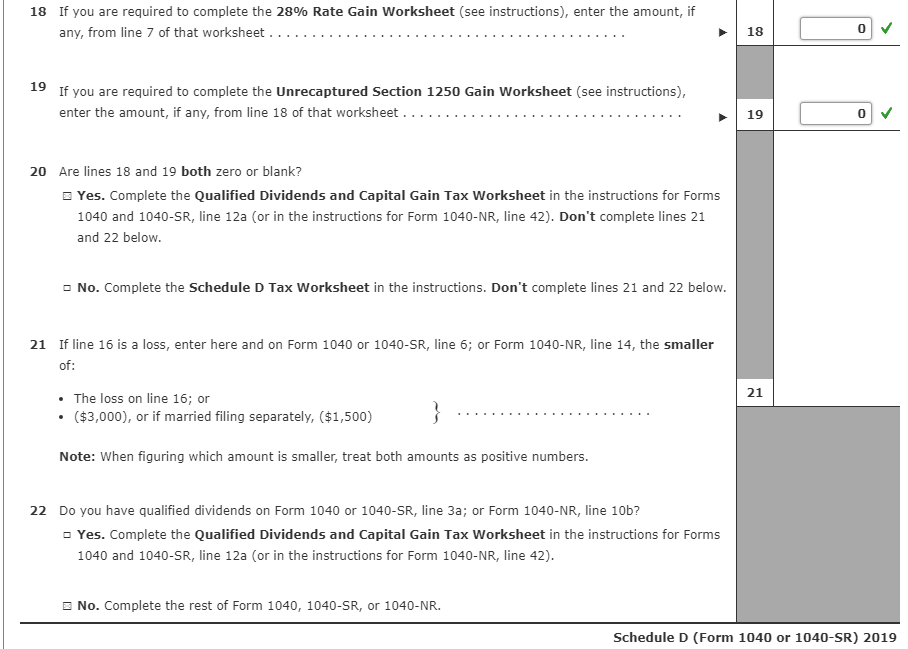

4 28-percent rate gain For purposes of this subsection the term 28-percent rate. Schedule D - Viewing Tax Worksheet If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D Form 1040 Capital Gains and Losses according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. Entries entered under Additional Capital Gain Distributions 28 Column entered via the Schedule D Other menu.

To ask a question on Tax. If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-one else report on Schedule D line 13 only the amount that belongs to.

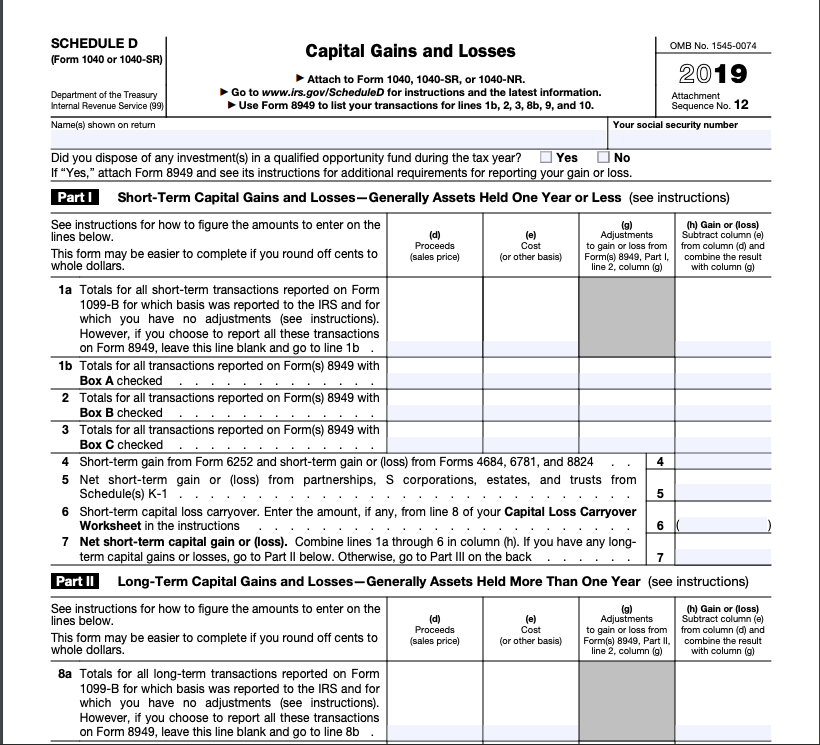

If you received capital gain distributions as a nominee that is they were paid to you but actually belong to someone else report on Schedule D line 13 only the amount that belongs to you. Schedule D Worksheets Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250. Online Capital Gains and Losses complete calculate print or save for later use.

Including the Capital Loss Carryover Worksheet 28 Rate Gain Workshee 2014 28 Rate Gain Worksheet Form 1040 Schedule D Instructions Page D-12. 28 Rate Gain WorksheetLine 18 in the Instructions for. Schedule D 28 Rate Gain Worksheet Line 18.

Rate Gain Worksheet in these instruc- tions if you. Get thousands of teacher-crafted activities that sync up with the school year. Stick to the fast guide to do Form Instructions 1040 Schedule D steer clear of blunders along with furnish it in a timely manner.

2013 28 Rate Gain Worksheet Form 1040 Schedule D Instructions Page D-11. Entries in Schedule D with an adjustment code of C. Get thousands of teacher-crafted activities that sync up with the school year.

Short Term Loss Carryover from prior year - The amount entered here goes to Schedule D Line 6 and is the short-term capital loss carryover from the prior year. 18 Enter the amount if any from line 7 of the 28 Rate Gain Worksheet in. To access the both worksheets in TaxSlayer Pro from the Main Menu of the tax.

Clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Ad The most comprehensive library of free printable worksheets digital games for kids.

Fill out this section of the IRS Schedule D tax worksheet in a similar manner as. Clude that amount on line 4 of the 28. The following items entered in the return will pull to the 28 Rate Gain Worksheet.

Ad The most comprehensive library of free printable worksheets digital games for kids. Was reported to the IRS and for which you have no adjustments see instructions. Most taxpayers who file Schedule D do not have amounts on line 18 which contains capital gain taxed at the 28 rate or line 19 where unrecaptured Sec.

And subsequent transactions are required to be reported to the IRS via the. This is archived information that pertains only to the 2004 Tax Year. If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet.

In TaxSlayer Pro the 28 Rate Gain Worksheet and the Unrecaptured Section 1250 Gain Worksheet are produced automatically as needed but there are amounts that may need to be entered on either worksheet by the preparer. 28-percent rate gain from 26 USC. Schedule D - Adjust 28 Rate 1250 Worksheet Menu.

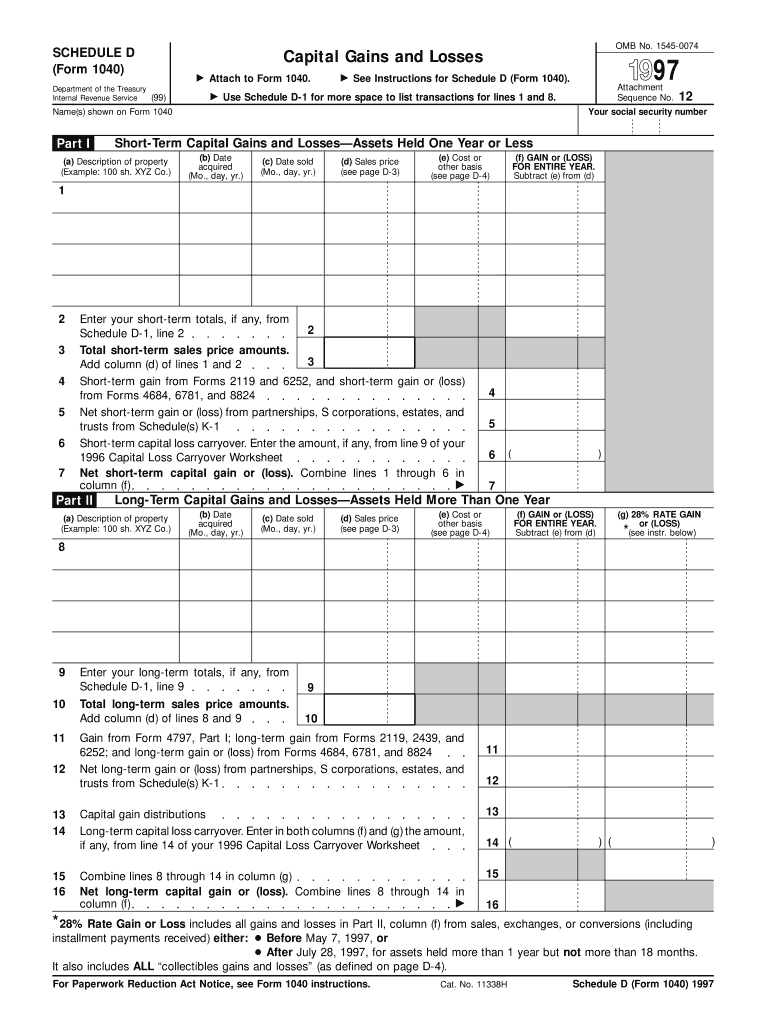

2012 28 Rate Gain Worksheet Form 1040 Schedule D Instructions Page D. The maximum tax rate on collectibles gain is 28 percent. If there is an amount in box 2d include that amount on line 4 of the 28 Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D.

28 rate gain worksheet 2020-2021. Instructions for Schedule D Form 1040 Capital. Online solutions help you to manage your record administration along with raise the efficiency of the workflows.

Short Term Loss Carryover from prior year The amount entered here goes to Schedule D Line 6 and is the short-term capital loss carryover from the prior year.

Form 1040 Schedule D Capital Gains And Losses

Form 1040 Schedule D Capital Gains And Losses

Detailed Irs Tax Filing Instructions For Section 1202 Qsbs Expert

Irs 1040 Schedule D 2010 Fill Out Tax Template Online Us Legal Forms

Tax Project Can You Help Me Fill Out Schedule D For Chegg Com

Publication 17 Your Federal Income Tax Chapter 17 Reporting Gains And Losses Comprehensive Example

Irs 1040 Schedule D Instructions 2020 2021 Fill Out Tax Template Online Us Legal Forms

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Tax Project Can You Help Me Fill Out Schedule D For Chegg Com

1040 Us Calculating Unrecaptured Section 1250 Gain At 25 Capital Gains Tax Rate

Instructions Comprehensive Problem 4 1 Skylar And Chegg Com

Publication 929 Tax Rules For Children And Dependents Tax For Children Under Age 14 Who Have Investment Income Of More Than 1 500

Publication 564 Mutual Fund Distributions Comprehensive Example

Tax Project Can You Help Me Fill Out Schedule D For Chegg Com

Form 1040 Schedule D Capital Gains And Losses

Publication 550 Investment Income And Expenses Chapter 4 Sales And Trades Of Investment Property Comprehensive Example

Irs 1040 Schedule D 1997 Fill Out Tax Template Online Us Legal Forms